Mobicash new name JazzCash, JazzCash charges list 2023

JazzCash Schedule of Charges January 2024 – June

2024

JazzCash Consumer Account

All products can be accessed through the JazzCash mobile app and USSD string *786# (for Jazz users only). Note: All

financial and non-financial transactions via USSD platform will have a platform fee of Rs. 1 (inclusive of Taxes)

charged effective 1st April’ 2023. The following transactions are excluded from the USSD charging;

ReadyCash, Loan Repayment, Saving & Insurance, My Account services except Mini

Statement.

Balance check will be charged at Rs. 0.50 from USSD.

Mobile Account Services

JazzCash Schedule of Charges 2024

1. General

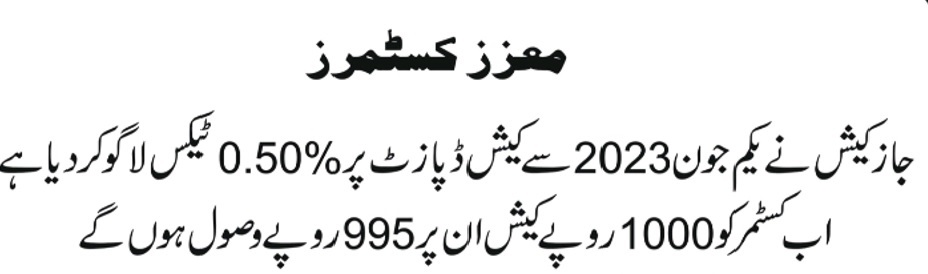

Cash Deposit karne per receiver account se deduction hogi. 01/06/2023

| Slabs | Fee |

| Rs. 50 – 20,000 | 0.50% + FED |

| Rs. 20,001 & Above | PKR. 100 +FED |

Other Charges

| Product | Charges |

| Account in-activity fee (Applicable in case of no activity in account for 12 months) | Rs. 100 |

| Mini Statement | No Charges |

| Asaan Digital Account | Rs. 100 |

2. Money Transfer

| Product | |

| Money Transfer from Mobile Wallet to CNIC | |

| Amount | Charges |

| 0 – 1,000 | Rs. 55 |

| 1,001 – 2,500 | Rs. 110 |

| 2,501 – 4,000 | Rs. 160 |

| 4,001 – 6,000 | Rs. 215 |

| 6,001 – 8,000 | Rs. 270 |

| 8,001 – 10,000 | Rs. 320 |

| 10,001 – 13,000 | Rs. 375 |

| 13,001 – 16,000 | Rs. 430 |

| 16,001 – 20,000 | Rs. 500 |

| 20,001 – 25,000 | Rs. 650 |

3.Cash Out from Mobile Wallet

| Amount | Charges |

| 1-200 | Rs. 7 |

| 201-500 | Rs. 12 |

| 501-1,000 | Rs. 20 |

| 1,001-2,500 | Rs. 40 |

| 2,501-4,000 | Rs. 70 |

| 4,001-6,000 | Rs. 100 |

| 6,001-8,000 | Rs. 130 |

| 8,001-10,000 | Rs. 180 |

| 10,001-13,000 | Rs. 230 |

| 13,001-16,000 | Rs. 280 |

| 16,001-20,000 | Rs. 330 |

| 20,001-25,000 | Rs. 380 |

| 25,001-30,000 | Rs. 470 |

| 30,001-40,000 | Rs. 560 |

| 40,001-50,000 | Rs. 690 |

| Product | Charges |

| IBFT into Mobile Wallet | No Charges |

| Wallet to Wallet Money Transfer* | Rs. 10 per transaction on amount greater than Rs. 100 |

| **IBFT from Mobile Wallet | Free up to an aggregate sending amount of PKR 25,000 per month; subsequent transactions charged at 0.1% + Tax of the amount or PKR 200 + Tax (lower amount to be charged) |

| ***1Link Transaction Processing Fee | Rs. 1 per transaction on all transactions below 25K 0.02% of transaction amount on all transactions between 25K & 200K Rs. 40 on transactions greater than 200K – charges are inclusive of tax & as per 1Link SOC |

| Deposit Via Debit Card | 3% + Tax would be charged to the customer on transaction amount |

| Deposit Via Bank Account | 1.2% + Tax would be charged to the customer on transaction amount |

*Money transfer charges from Wallet to Wallet are not applicable till further instructions from SBP on COVID-19

**IBFT charges from Mobile Wallet are applicable till as per time to time instructions from SBP on COVID-19/any other special notification.

*** A transaction processing fee will be recovered for all IBFT Mobile Wallet transactions as per 1-link SOC.

4. Bill Payment

| Product | Charges |

| Postpaid Bill Payment | No Charges |

| Prepaid Load | No Charges |

| Other Operator Prepaid Load through Mobile Wallet | No Charges |

| Internet Bill Payment | No Charges |

| Utility Bill Payment | Rs. 5.00 (Incl. Tax) per bill for first 3 bill payments in a month. Rs. 20.00 (Incl. Tax) per bill after 3rd bill payment in a month Rs. 30.00 (Incl. Tax) per bill after 9th bill payment in a month Charges as per calendar month |

| IBFT Outgoing from OTC/CNIC | |

| Amount | Charges*** |

| 0 – 1,000 | Rs. 35 |

| 1,001 – 2,500 | Rs. 50 |

| 2,501 – 4,000 | Rs. 65 |

| 4,001 – 6,000 | Rs. 80 |

| 6,001 – 8,000 | Rs. 90 |

| 8,001 – 10,000 | Rs. 105 |

| 10,001 – 13,000 | Rs. 120 |

| 13,001 – 15,000 | Rs. 130 |

| 15,001 – 20,000 | Rs. 165 |

| 20,001 – 25,000 | Rs. 200 |

| 25,501 – 30,000 | Rs. 250 |

| 3,0001 – 40,000 | Rs. 325 |

| 40,001 – 50,000 | Rs. 400 |

***Inclusive of 1-Link charges

1. General

| Product | Charges |

| Account Registration | No Charges |

| Account Maintenance | No Charges |

| SMS Alerts for Every Transaction | No Charges |

| MPIN Creation | No Charges |

| MPIN Change | No Charges |

| Access to Mobile Account | No Charges |

| Balance Enquiry | No Charges |

| Mini Statement Mobile App/Online | No Charges |

| Email Statement via Mobile App/Online | No Charges |

| Balance Enquiry via 1-Link/M-NET ATM | Rs 3.13 |

JazzCash Business Account

JazzCash Business Account

All products can be accessed through the JazzCash mobile app and USSD string *800# (for JazzCash Merchants).

Note: All financial and non-financial transactions via USSD platform will have a platform fee of Rs. 1 (inclusive of Taxes) charged effective 1st April’ 2023. The following transactions are excluded from the USSD charging; ReadyCash, Loan Repayment, Saving & Insurance, My Account services except Mini Statement. Balance check will be charged at Rs.0.50 from USSD.

2. Money Transfer

| Product | Charges |

| Send Money To Another JazzCash Mobile Wallet | No Charges |

| Receive Money from CNIC (CNIC to Business Account Transfer) | No Charges |

| Send Money to Any Bank Account* | Free up-to Rs. 50,000 per month, subsequent transactions charged at 0.1% or Rs.200 whichever is less |

| Receive International Remittance | No Charges |

| **IBFT from Mobile Wallet | Free up to an aggregate sending amount of PKR 25,000 per month; subsequent transactions charged at 0.1% + Tax of the amount or PKR 200 + Tax (lower amount to be charged) |

| ***Transaction Processing Fee | Rs. 1 per transaction on all transactions below 25K 0.02% of transaction amount on all transactions between 25K & 200K Rs. 40 on transactions greater than 200K – charges are inclusive of tax |

*IBFT charges from Mobile Wallet are applicable till as per time-to-time instructions from SBP on COVID-19/any other special notification. **IBFT charges from Mobile Wallet are applicable till as per time to time instructions from SBP on COVID-19/any other special notification. *** A transaction processing fee will be recovered for all IBFT Mobile Wallet transactions as per 1- link SOC.

3. Bill Payment

| Product | Charges |

| Mobile Top-Up for any operator | No Charges |

| Utility Bill Payment | Rs. 5.00 (Incl. Tax) per bill for first 3 bill payments in a month. Rs. 20.00 (Incl. Tax) per bill after 3rd bill payment in a month Rs. 30.00 (Incl. Tax) per bill after 9th bill payment in a month Charges as per calendar month |

4. Cards

| Product | Charges |

| MasterCard Debit Card Issuance fee for Merchants | Rs. 1 |

| PayPak Debit Card Issuance fee for Merchant | Rs. 899 |

| PayPak Debit Card Annual Fee | Rs. 299 |

| Debit Card PIN Creation / Change | No Charges |

OTC Services

1. Cash Deposit into Business Account

| Cash Deposit into Business Account | No Charges |

2. Payment Acceptance Service Charges on Business Account

| Use-case | Total FEE (Incl. FED) |

| Standard MDR on receiving QR/Till Payments | 1% |

| Standard MDR on In-coming IBFT | 2% |

| Standard MDR on receiving Funds from JazzCash Account | 2% |

3. Payment Acceptance Services via Online Payments Gateway

| Use-case | Total FEE (Incl. FED) |

| Cash Withdrawal from Business Account through ATM via 1Link | No Fee upto Rs. 50,000 then Rs. 23.44 per withdrawal |

4. Cash Withdrawal from Business Account through JazzCash Agent, JazzCash merchant account withdrawal charges

| Amount | Charges |

| 1-200 | Rs. 7 |

| 201-500 | Rs. 12 |

| 501-1,000 | Rs. 20 |

| 1,001-2,500 | Rs. 40 |

| 2,501-4,000 | Rs. 70 |

| 4,001-6,000 | Rs. 100 |

| 6,001-8,000 | Rs. 130 |

| 8,001-10,000 | Rs. 180 |

| 10,001-13,000 | Rs. 230 |

| 13,001-16,000 | Rs. 280 |

| 16,001-20,000 | Rs. 330 |

| 20,001-25,000 | Rs. 380 |

| 25,001-30,000 | Rs. 470 |

| 30,001-40,000 | Rs. 560 |

| 40,001-50,000 | Rs. 690 |

EASYPAISA SCHEDULE OF CHARGES 2023

Top

Home

Note:

- Cash withdrawal charges will be deducted from your Mobile Account. There is no need to pay the charge in cash to the Agent

- Transaction limits are applicable

- All fees/charges are inclusive of FED

- 2 Free ATM withdrawals will be allowed for freelancers in a month when they receive remittance

- Acceptance services and online payment MDR has been separately mentioned in the business account service charges section on www.jazzcash.com.pk